In light of recent developments regarding Paytm Payments Bank and its FASTag services, customers may find themselves needing to close their existing FASTag accounts and transfer to a different provider. With the National Highway Authority of India removing Paytm Payments Bank from its list of authorized banks for FASTag, understanding the process for closing and transferring your FASTag account becomes paramount. The procedure involves several steps starting from deactivating the current FASTag to setting up a new one with another bank. Here, we will see How to Close and Transfer Your Paytm Payments Bank FASTag Account Efficiently.

Deciding to shift your FASTag account from Paytm is a decision influenced by recent regulatory actions, and the process involves both careful consideration and prompt action to ensure seamless toll payments during travels. It is crucial to recognize that while Paytm FASTags remain operational until their balance runs out, a transition plan should be put in place before funds run dry. Accordingly, preparing for this change requires a systematic approach from verifying identity with existing providers to engaging with new banks for a flawless transfer and continues service.

Key Takeaways

- Closing a Paytm FASTag account requires identity verification and contacting customer service.

- Transferring a FASTag involves choosing a new bank and applying for a new tag.

- Post-transfer, it’s vital to link the new FASTag with the vehicle’s registration details.

Table of Contents

Understanding Paytm Payments Bank FASTag

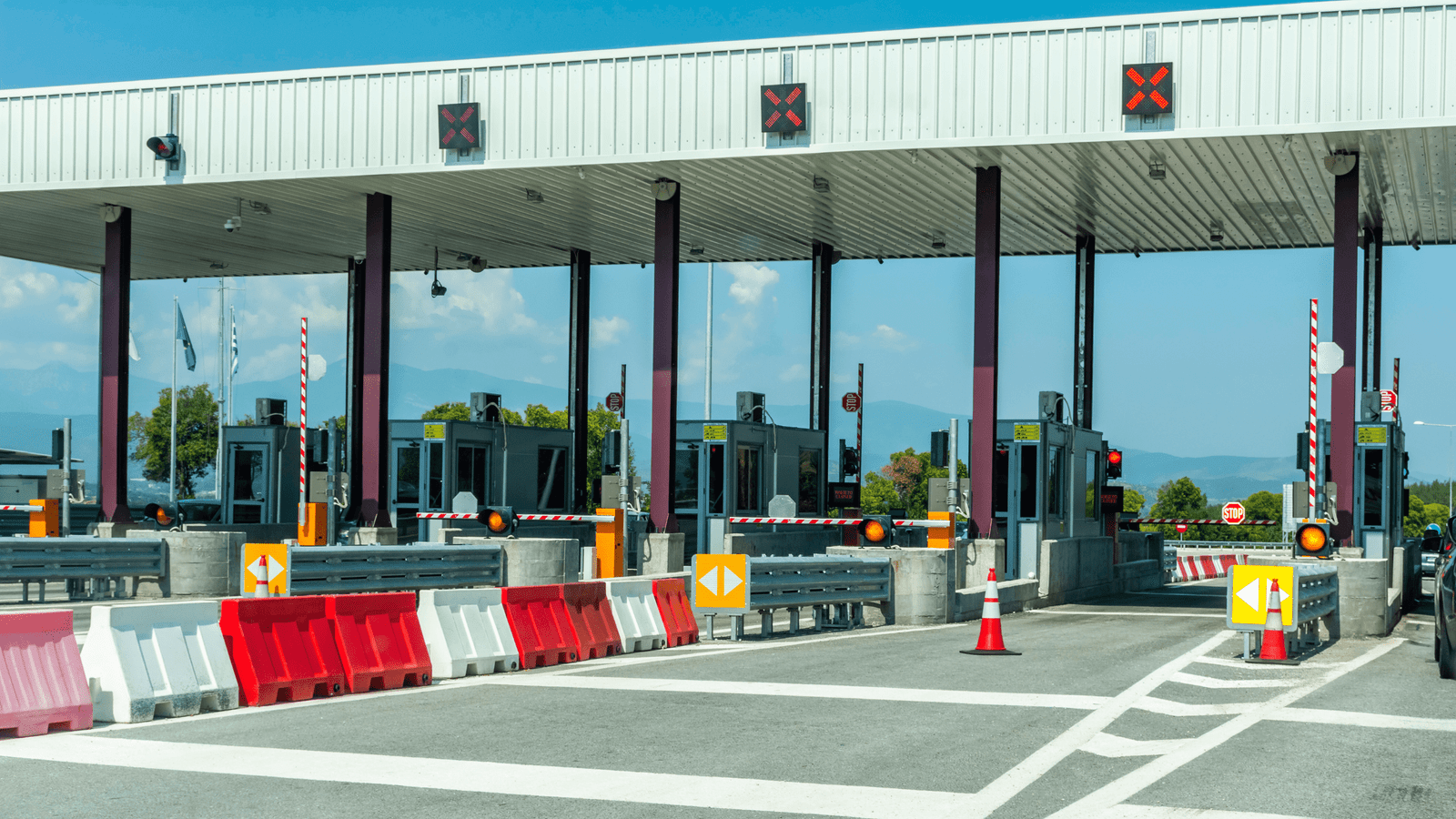

Paytm Payments Bank offered a service known as FASTag, which was an electronic toll collection system in India, operated by the National Highways Authority of India (NHAI) through the Indian Highways Management Company Limited (IHMCL). The system employed RFID technology for making toll payments directly from the prepaid or savings account linked to it.

Key Features of Paytm Payments Bank FASTag:

- Electronic Toll Collection: Allowed automatic toll fee deductions, promoting a cashless payment method.

- RFID Technology: Utilized Radio-frequency Identification for the seamless passage through toll plazas.

- Linking Facilities: Customers could link the FASTag with their Paytm wallet, for frictionless recharge and tracking.

FASTag users had to affix the RFID tag on their vehicle’s windscreen. When they drove through NHAI toll plazas, the sensor would read the vehicle registration number from the tag and deduct the toll fee from the linked Paytm Payments Bank account or wallet.

However, according to recent notifications, Paytm Payments Bank has faced restrictions from the Reserve Bank of India (RBI). Users have been advised to deactivate their FASTag account associated with the bank and opt for a new issuer to continue using FASTag services without interruption.

Current Status:

- Paytm Payments Bank can no longer issue new FASTags but existing tags remain operational till the balance runs out.

- Users are encouraged to transfer their FASTag to other authorized banks working with NHAI’s electronic toll collection system.

Pre-closure Checklist

Before proceeding with the closure of your Paytm FASTag account, it is important to ensure that both your account balance and vehicle details are in order. This preparatory step helps avoid any unforeseen complications during the transfer process.

Verify Account Balance and Details

Firstly, account holders should verify their Paytm FASTag balance to ensure that there are no outstanding dues. The Paytm app can be used to check the current tag balance. If the balance is positive, one should transfer the existing balances to their bank account or request a refund. Account details, including KYC (Know Your Customer) information, must be up-to-date and correct. It’s advisable to rectify any discrepancies in mobile number and personal details before proceeding to close the account.

- Balance: Ensure it reflects correctly on the app.

- Personal Details: Confirmed with the bank’s records.

Documenting Vehicle Information

Subsequent to account verification, documenting comprehensive vehicle information is vital. This includes verifying the Vehicle Registration Number (VRN) and obtaining a copy of the Registration Certificate (RC). Furthermore, accurate identification of the vehicle class is necessary to facilitate a seamless transfer of the Paytm FASTag.

- VRN: Verify it matches the one on the FASTag.

- RC: Keep a copy for the transfer process.

- Vehicle Class: Confirmation required for appropriate FASTag categorization.

Initiating the FASTag Account Closure

Closing a Paytm FASTag account is a process that requires the user to follow specific steps for a smooth termination of services. This involves deactivation of the FASTag, ensuring KYC details are up-to-date, and managing the transfer of any residual wallet balances.

Steps to Close Paytm FASTag

- Open the Paytm App: Users must start by opening the Paytm app on their mobile device.

- Navigate to FASTag Section: Within the app, one should locate the ‘Manage FASTag’ option, which is where the closure process begins.

- Request for Closure: The user needs to select ‘Close FASTag’ to initiate the deactivation process.

- Verification: For security purposes, the user will have to verify their identity, using KYC details linked to their account.

- Confirmation: After verification, the user must confirm the closure request; a notification of the deactivation will be provided by Paytm.

Transferring Funds and Deactivating Services

- Wallet Balances: Before deactivating the FASTag, the user should transfer out any existing wallet balances to their bank account.

- Withdrawal Process: This usually entails going to the wallet section, selecting the withdrawal option, and choosing an account for the funds transfer.

- Service Deactivation: It is imperative to ensure all related services connected to the FASTag, such as auto top-ups and scheduled payments are deactivated to prevent future unwanted transactions.

- Final Steps: Once the FASTag is closed and the balance transferred, the user receives a confirmation, completing the closure and deactivation process.

It is important to remember that once a FASTag is closed, the deactivation is permanent and the tag cannot be reactivated. For vehicle owners transferring to a different FASTag provider, they must reach out to the new issuer to purchase a new FASTag and update their vehicle registration details accordingly.

Transferring to Another Bank

Transferring a Paytm Payments Bank FASTag to another bank requires customers to carefully choose a new FASTag provider, port their FASTag account accordingly, and ensure that their toll payments remain uninterrupted during their journeys.

Choosing a New FASTag Provider

Customers must evaluate and select a new FASTag provider from the range of banks offering this service. It is critical to consider factors such as user interface, customer support, and the efficacy of the onboarding process. The choice of provider will impact the ease with which customers can manage their toll payments at various toll plazas.

Porting FASTag to the New Provider

After settling on a provider, customers must initiate the porting process. This involves raising a surrender request to deactivate the existing FASTag with Paytm Step-By-Step Guide to Transfer and then completing the necessary steps for onboarding with the selected bank. This may include submitting KYC documents and vehicle details for the new FASTag to be issued.

Ensuring Uninterrupted Toll Payments

To ensure a smooth transition and uninterrupted access to toll services, customers need to carefully time the porting process. The FASTag should only be deactivated with the current provider once the new one is reactivated and ready to use. Customers must also be aware of any potential downtime and plan their journeys to avoid inconveniences at toll plazas.

After the Transfer: What Next?

Once the transfer of your Paytm Payments Bank FASTag account is complete, attention turns to confirming the successful transition and preparing for any subsequent requirements or issues that may arise.

Confirmation and Customer Support

After initiating the transfer, it’s essential for customers to receive confirmation that their FASTag services have been successfully moved to the new provider. Typically, this confirmation comes via SMS or email, including details like the new tag ID and the carrier. It’s crucial to verify that the RFID tag is active and correctly associated with your vehicle in the new system. In case of discrepancies or if customers need help, immediate contact with customer support should be a priority. Reputable FASTag providers offer help & support through various channels, including toll-free numbers, live chat, and email.

Customer service is a critical aspect following a FASTag account transfer. Customers are encouraged to reach out to their new FASTag provider for any enquiries or assistance. In the event of queries regarding balances that were to be refunded from the old account, contacting customer service of the former provider is advised. The Reserve Bank of India has set guidelines to protect customers in financial services, ensuring that customer support addresses all valid user concerns post-transfer.

Dealing with Post-transfer Scenarios

Post-transfer, customers may need to deal with several scenarios related to their FASTag account. If there is an existing balance in the Paytm FASTag, be aware that it can no longer be recharged after a specified date and the balance can be used until depleted. It’s crucial to ensure that your new FASTag account is properly set up with sufficient funds to avoid disruptions in service at toll plazas.

Furthermore, customers should also proactively monitor their FASTag accounts for any duplicate charges or issues related to tag detection. If such post-transfer scenarios occur, reaching out to the new FASTag services for resolution is necessary. Keeping documentation of the old account details and transfer process can aid in resolving any disputes swiftly. Continued updates and news from reliable sources about FASTag policies, such as those from the Reserve Bank of India, can help customers stay informed of any new regulations or changes in service terms.

Frequently Asked Questions

Navigating the procedures for handling Paytm Payments Bank FASTag accounts requires understanding specific steps for closure, transfer, and deactivation. Here are precise answers to common questions regarding these processes.

What is the process for closing a Paytm Payments Bank FASTag account?

To close a Paytm Payments Bank FASTag account, one must open the Paytm app, go to the FASTag section, and select the option to deactivate the FASTag. Detailed instructions are available on Paytm Payments Bank’s website.

Can I transfer my Paytm FASTag balance to a different bank’s FASTag account?

The balance from a Paytm FASTag cannot be directly transferred to another bank’s FASTag account. Instead, the balance needs to be refunded to a bank account, and from there, it can be transferred to a different FASTag account.

How do I port my Paytm FASTag to another FASTag provider?

Porting to another FASTag provider involves closing the FASTag with Paytm and applying for a new FASTag with the preferred provider, as there is no direct porting option available.

What steps should I follow to deactivate my FASTag account with Paytm?

Deactivating a FASTag with Paytm involves accessing the FASTag management options in the Paytm app, selecting the desired FASTag account, and following the prompts for deactivation. Assistance from Paytm Customer Care may also be sought.

How can I move my FASTag from Paytm to an Airtel FASTag account?

Moving a FASTag from Paytm to Airtel requires deactivating the Paytm FASTag and then applying for a new FASTag through Airtel’s application process.

Is it possible to recharge my Paytm FASTag after closure or transfer?

Once a Paytm FASTag account is closed or transferred, it cannot be recharged. Any existing balance should be used or requested for refund prior to closure.